Cardano Price Sends Mixed Signals. What Awaits In the Coming Weeks?

[ad_1]

ADA price is at $0.854 at the time of writing, which represents a 20% decline from recent highs yet a 1.6% weekly increase, in line with a broader market rebound. One thing that sets Cardano apart from other cryptocurrencies is its focus on long-term viability, scalability, and utility. Optimism is dampened, though, by bearish pressures from falling on-chain activity and rivalry from faster chains such as Solana.

ADA Price Performance in August Is a Mixed Bag

The coin started strong in August, rising to briefly cross the $1 psychological mark in mid-month. The resiliency of ADA was on show despite a following market-wide downturn that witnessed profit-taking and some pullback. The token’s ability to cling onto important support levels and sustain double-digit weekly gains is evidence of the community’s underlying strength and investors’ rising confidence.

On-Chain Metrics Tell the Story

The recent price action was supported by important fundamental and on-chain events rather than just speculative activity. One significant positive signal was the community’s decision to support the use of $71 million from the Cardano treasury to finance improvements to the core network, such as the Hydra scalability solution and the Ouroboros Leios consensus system.

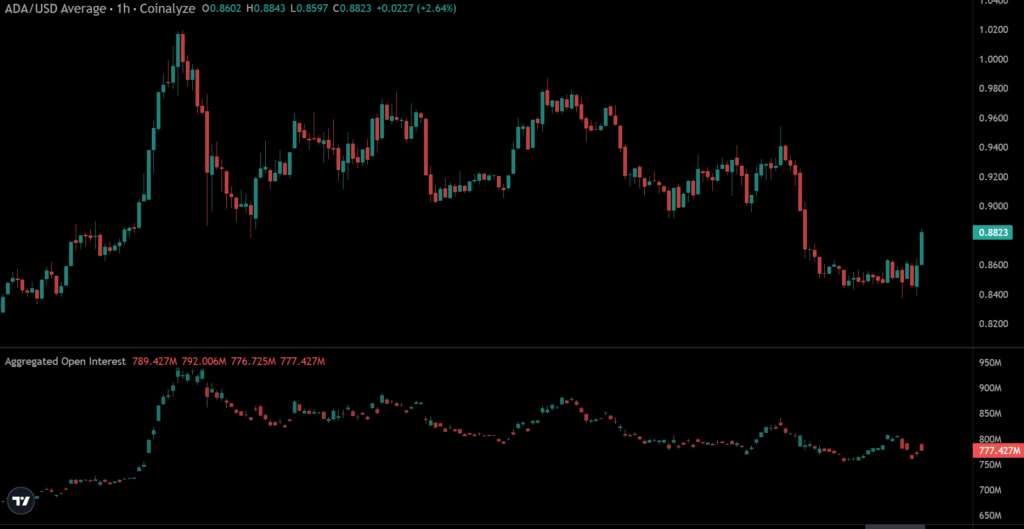

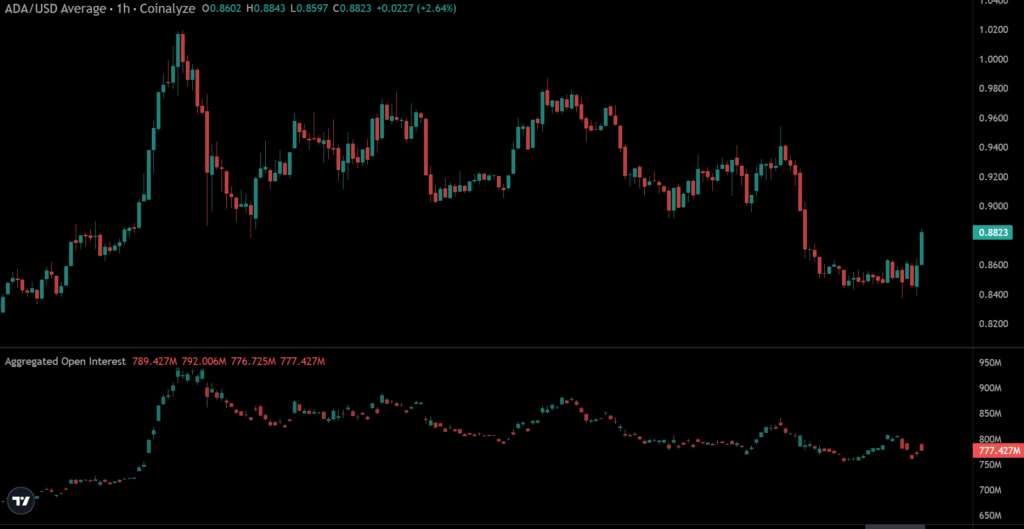

Similarly encouraging was the August on-chain data. ADA’s futures open interest hit a record high of more than $1.44 billion, indicating a sharp rise in market activity and speculative interest. This spike was seen as a sign of increased volatility and, if supported by solid fundamentals, a possible market rally.

ADA Price and Aggregated Open Interest chart. Source: TradingView

Cardano’s fee income is still modest when compared to its L1 competitors, which has two drawbacks: it has attractive user prices but less direct value capture.

Cardano DeFi Performance Stays Resilient

For the most part in August, Cardano’s DeFi total value locked (TVL) stayed between $350 and $400 million. Today, DefiLlama shows it at $393 million. Even while it’s not on par with Ethereum, the continuous growth from the beginning of the year makes ADA collateral and liquidity incentives more desirable. Although it is still in its infancy, Cardano’s DeFi has risen by 33% in TVL, signaling good support for further price increases.

Once lagging behind its rivals, Cardano’s DeFi ecosystem demonstrated remarkable development and maturity in August 2025. There has been a monthly increase in trading activity that has surpassed $1 billion on the lending protocols and DEXs. Midnight, Cardano’s next sidechain that will focus on privacy features that follow the rules, will come out in the fourth quarter of 2025. This might attract a lot of new institutional and business customers, as well as money, to its DeFi ecosystem.

A screen grab of DeFi chain performances with Cardano at position 21. Source: DeFiLlama

ADA Spot ETF Approval Likely In the Coming Weeks

The prospect of a spot Cardano ETF has fueled ADA’s 2025 narrative, with approval odds soaring to 81-90% on Polymarket, up from 59% earlier in August. If approved, ADA could rally and potentially reflect Ethereum and Bitcoin’s post-ETF success.

ADA Price Q4 2025 Outlook

A very bright picture emerges for Cardano in the fourth quarter of 2025. The coin is in a good place for a rally because it built a strong base in August. The likely approval of an ETF and the continuous rollout of important network upgrades are the main things that will drive the last quarter of the year.

If a spot Cardano ETF gets the green light, the price might go up in a big way, with some predictions saying it could reach $3 or more. Even if there isn’t an instant permission for an ETF, the price will likely stay up because of the ongoing network upgrades and the growth of the DeFi ecosystem. The Midnight sidechain’s introduction is a very crucial step forward since it will create new uses and bring in a new type of enterprise clients.

Regulation is the wild card for ADA price. Any real progress or setbacks on the ETF front would quickly change people’s minds, but the information we have now suggests that we should be patient rather than expect something to happen soon. Trend traders might be hesitant to jump on breakouts until the 50-day and 200-day moving average crossing takes place. Mixed MA signals can cap rallies.

The post Cardano Price Sends Mixed Signals. What Awaits In the Coming Weeks? appeared first in UK on InvestingCube.

[ad_2]Excerpt: [excerpt]

Read full article on [source_title]

This post contains excerpts from the original article. All rights belong to the respective author.

Leave a Reply