Budget Cycle in India

The budget cycle in India refers to the formal process through which the government prepares, presents, approves, and executes its financial plan for the upcoming fiscal year. It is a comprehensive and detailed procedure that involves several stages and actors, including ministries, government agencies, Parliament, and the President of India. The Indian budget cycle follows a systematic process governed by constitutional provisions, particularly Article 112 of the Indian Constitution, which mandates the presentation of an Annual Financial Statement (the Union Budget).

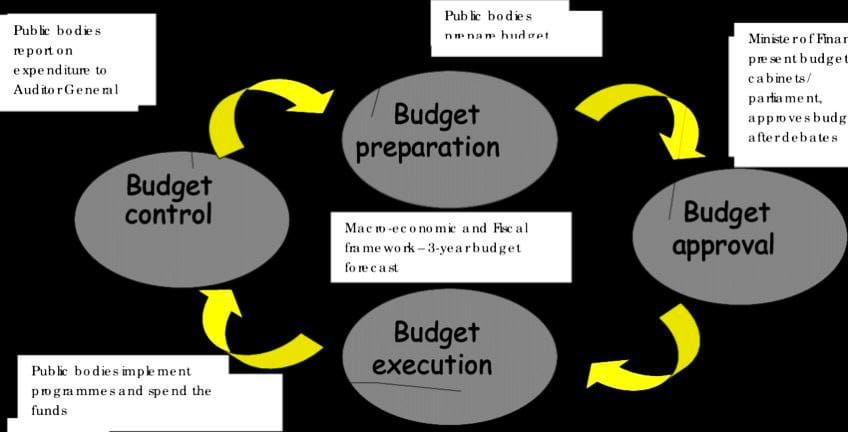

India’s fiscal year runs from April 1 to March 31 of the following year. Below are the key stages of the budget cycle in India :

1. Budget Formulation (Preparation Stage)

This is the first and most crucial stage of the budget cycle, where the government departments and ministries prepare their budget estimates for the upcoming fiscal year.

Steps Involved:

- Budget Circular Issued: Around September or October, the Ministry of Finance issues a circular to all ministries, departments, and agencies, asking them to submit estimates of their revenue and expenditure for the upcoming fiscal year. This includes both revenue and capital budgets.

- Preparation of Estimates: Each ministry/department prepares its budget estimate based on past expenditures, new projects, and policy changes. These estimates are sent to the Department of Expenditure within the Ministry of Finance for scrutiny.

- Review and Discussion: The Department of Expenditure reviews these submissions and holds discussions with individual ministries/departments to finalize the proposed allocations.

- Revenue and Tax Estimates: Simultaneously, the Department of Revenue (within the Ministry of Finance) prepares estimates of tax revenues (direct and indirect taxes), while the Department of Economic Affairs estimates non-tax revenues and foreign receipts.

- Finalization by the Ministry of Finance: Based on revenue projections and expenditure needs, the Finance Ministry consolidates all proposals and formulates the final budget document.

Outcome: A draft budget proposal for the upcoming fiscal year is prepared by the end of January.

2. Budget Presentation (Legislation Stage)

The Union Budget is traditionally presented on February 1 each year by the Finance Minister. The budget presentation marks the formal introduction of the government’s financial plans for the upcoming fiscal year.

Key Steps:

- Budget Speech: The Finance Minister presents the budget speech in Lok Sabha (the lower house of Parliament), outlining the government’s economic policies, spending priorities, and revenue generation strategies. The speech usually includes:

- Part A: Policy announcements, reforms, and macroeconomic outlook.

- Part B: Taxation proposals, changes in tariffs, duties, and other fiscal measures.

- Budget Documents: Along with the speech, various budget documents are presented, including:

- Annual Financial Statement (Union Budget).

- Finance Bill (proposing changes in tax laws).

- Demand for Grants (detailed allocations for each ministry).

- Appropriation Bill (for withdrawing funds from the Consolidated Fund of India).

- Presentation in Rajya Sabha: The budget is also laid before the Rajya Sabha (upper house), but it does not vote on the budget.

Outcome: The budget is formally introduced and made public.

3. Budget Approval (Parliamentary Stage)

Once the budget is presented, it must be approved by Parliament before the government can start spending for the next fiscal year. The approval process takes about a month.

Key Steps:

- General Discussion: After the budget presentation, a general discussion takes place in both the Lok Sabha and Rajya Sabha. Members of Parliament (MPs) debate the budget’s policy proposals and the overall fiscal stance of the government, but no voting takes place during this phase.

- Departmental Standing Committees: The detailed expenditure proposals (Demand for Grants) are referred to Standing Committees of Parliament, each focusing on a specific ministry. These committees review the budget proposals in-depth and submit their recommendations to the House.

- Voting on Demand for Grants: After the standing committees submit their reports, the Lok Sabha begins a detailed discussion on the Demand for Grants. MPs can raise objections or suggest changes. However, only the Lok Sabha votes on the grants. Rajya Sabha can only discuss them but cannot vote.

- Passing of Appropriation Bill: After voting on the grants, the Appropriation Bill is introduced and passed by Lok Sabha. This bill allows the government to withdraw money from the Consolidated Fund of India to meet its expenditures.

- Passing of Finance Bill: The Finance Bill is then discussed and passed, which legally authorizes changes in taxation and other revenue-raising measures proposed in the budget.

- President’s Assent: Both the Appropriation Bill and Finance Bill are sent to the President of India for his/her assent, making them legally binding.

Outcome: The budget is formally approved by Parliament, allowing the government to spend and collect revenue as per the budget plan.

4. Budget Execution (Implementation Stage)

Once the budget is approved, the government begins the execution phase, which involves the actual collection of revenues and the spending of allocated funds by various ministries and departments.

Key Steps:

- Release of Funds: The Ministry of Finance releases funds to various ministries, departments, and state governments in line with the budgetary allocations.

- Monitoring and Reporting: The Ministry of Finance and the Controller General of Accounts monitor the use of funds to ensure they are spent according to the approved budget.

- Revised Estimates: Around the middle of the fiscal year (typically in December), the government prepares Revised Estimates (RE) based on actual expenditure and revenue trends. These estimates may require adjustments to the original budget figures.

Outcome: Government programs and projects are implemented, and expenditures are incurred as per the approved allocations.

5. Budget Auditing (Evaluation Stage)

The final stage in the budget cycle is auditing and evaluation, where the actual spending and revenue collections are scrutinized to ensure compliance with the approved budget.

Key Steps:

- Comptroller and Auditor General (CAG): The CAG audits the accounts of the government and submits reports to Parliament on how public funds were spent. This ensures accountability and transparency in public finances.

- Public Accounts Committee (PAC): The PAC, a parliamentary committee, reviews the CAG’s audit reports and ensures that the government’s spending was in line with the approved budget and followed proper procedures.

Outcome: The government’s financial management is scrutinized, and recommendations are made for improving future budget practices.

Conclusion

The Budget Cycle in India is a detailed and structured process involving multiple stages from preparation to evaluation. Each stage, from formulation to execution and auditing, plays a critical role in ensuring that the government’s financial resources are efficiently allocated and spent. The cycle is not only a financial mechanism but also a tool for economic policy, governance, and accountability in a democratic setup. The process enables public participation through elected representatives, ensuring that the government’s financial decisions align with national priorities and public welfare.